Defining an Option in DCM

The notions of future and option (call options, put options) are core concepts in derivative trading—yet they resist formal definition.

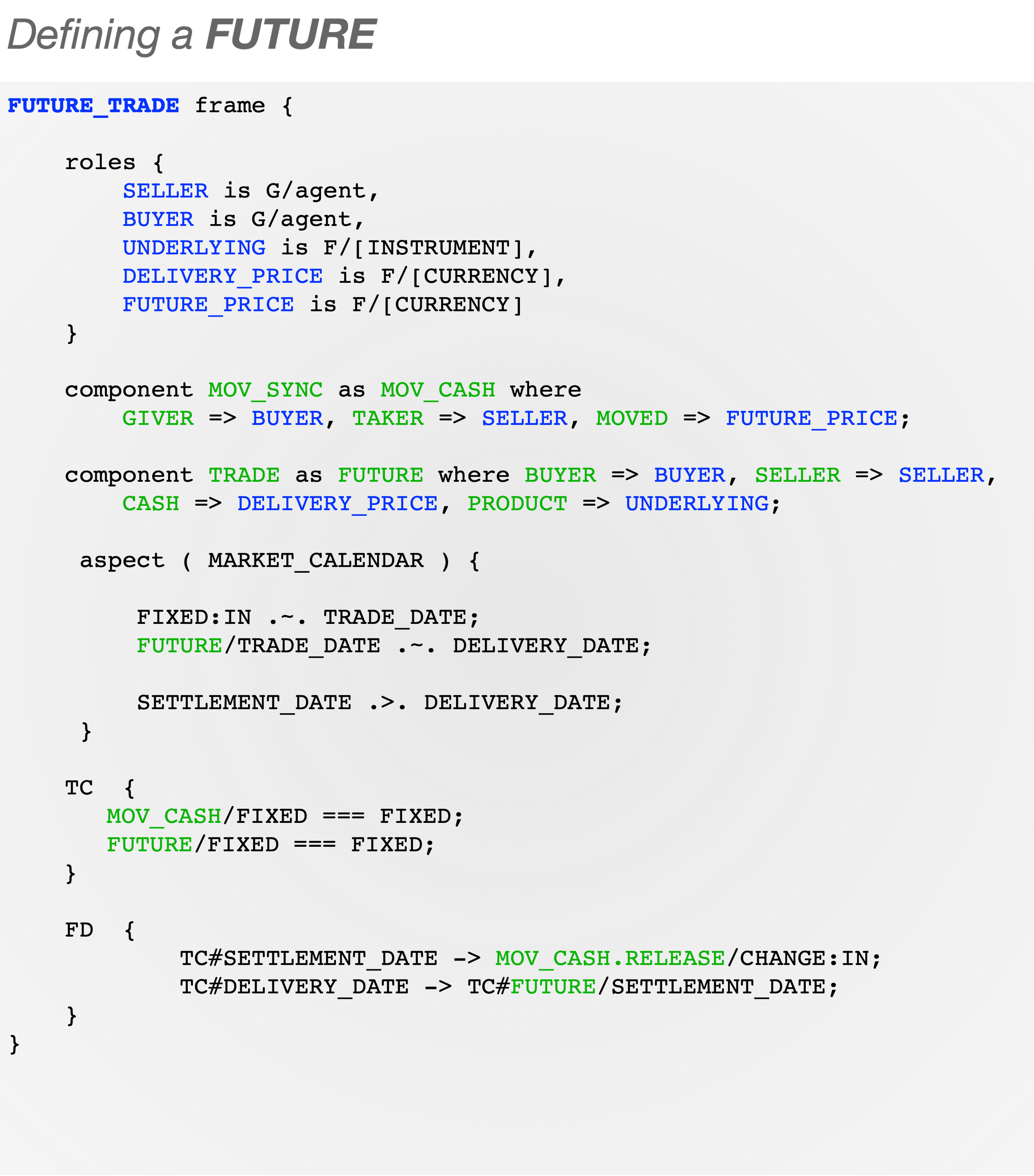

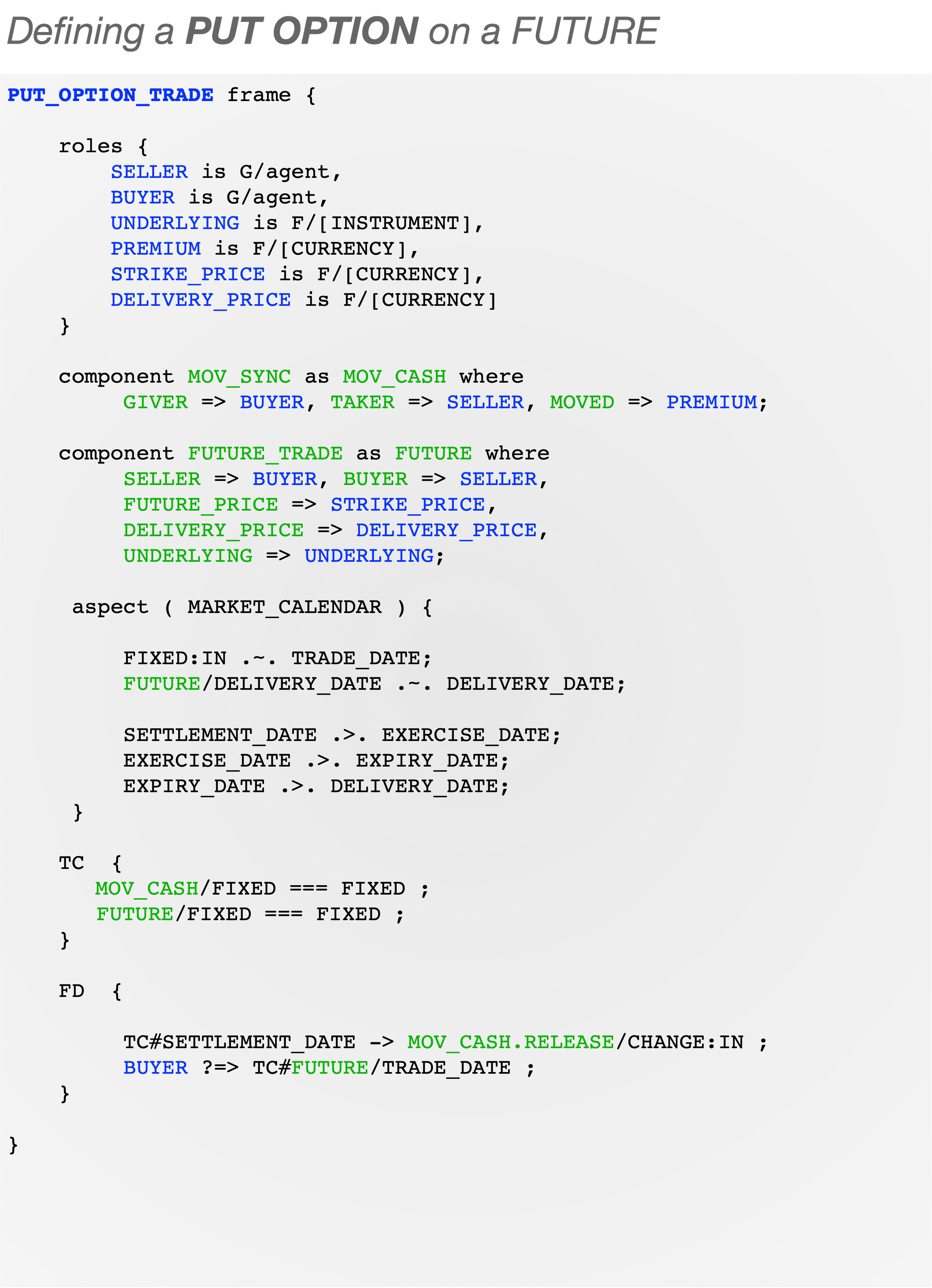

Here, we demonstrate how these notions can be formalized, and thereby made executable or clearable in the same way as the TRADE concept in the previous example.

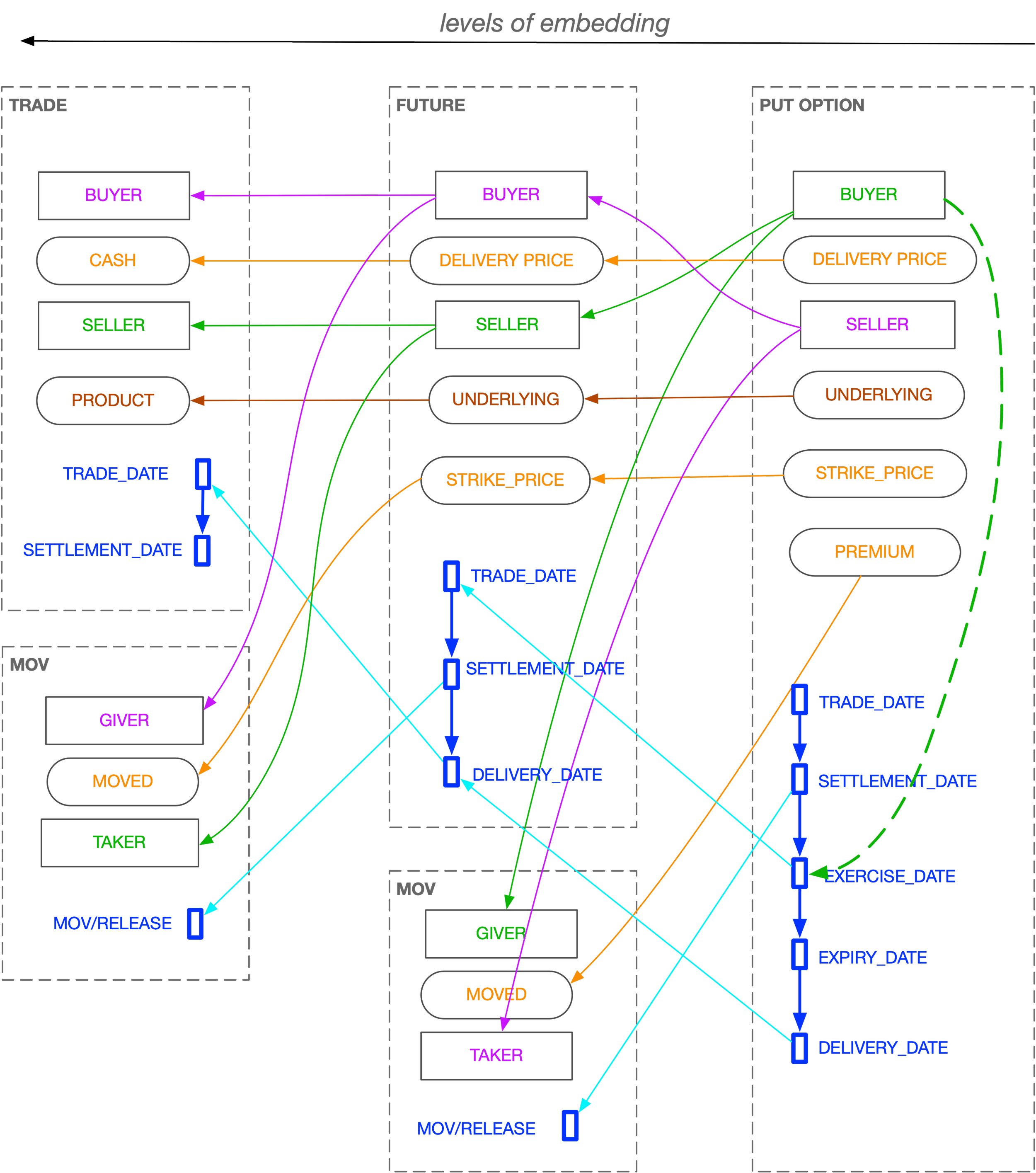

It’s important to note that the perceived complexity of (understanding) the notion of an option—particularly for a novice—stems from the presence of multiple levels of embedding, as well as from the repeated appearance of the same component frame, MOV (representing movement of cash), and the same role names (BUYER and SELLER) at different levels of embedding.

In DCM, the PUT OPTION is a frame with a deep composition path, much like a Russian doll, comprising at least four levels (excluding levels that merely elaborate a frame without composing several different frames into one).

Importantly, each level remains visible and maintains its own independent existence (as a fibre) within the target construal modelling the option. This ensures that the internal structure of the option remains amenable to modifications at any of these four levels.

Thus, for example, if we are only concerned with the movement of cash for the sake of regulatory or client reporting, we can implement the solution at the level of the MOV frame, where the figure has nominal construal of cash. This solution will work across all types of contracts (frames) that are defined—including stock trades, futures, options, borrowing and lending—without even needing to know which ones are present.

In this sense, structures (frames) built within DCM are transparent and open to access and modification along many dimensions—through multiple POVs represented by different frames—simultaneously.